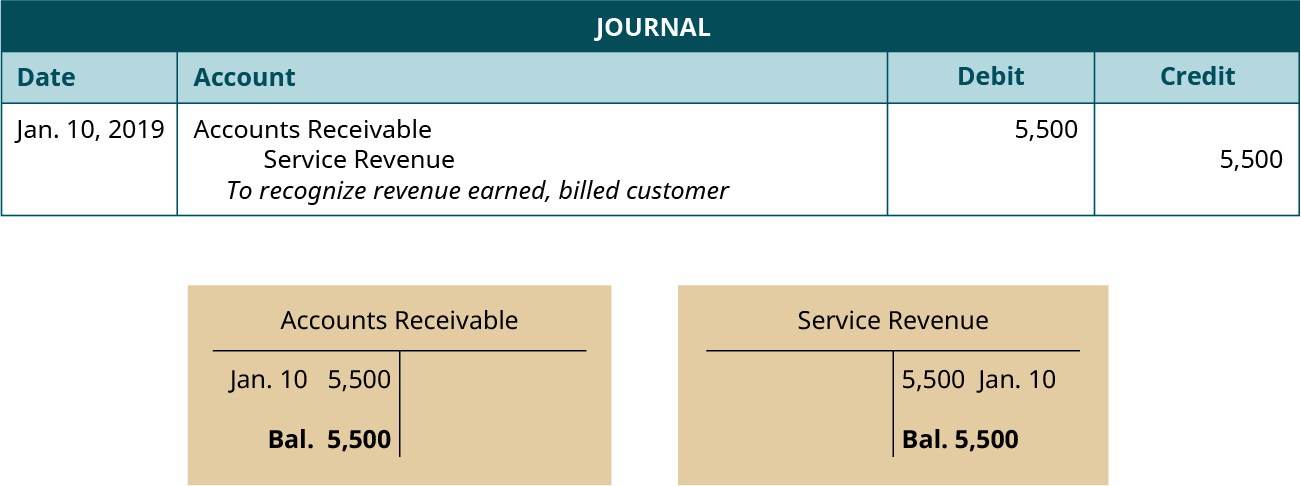

Likewise, if you invest in a new SaaS product, you will need to credit your cash account and debit your asset account accordingly every month, quarter or year, depending on the payment terms. The depreciation expense will be debited, while the accumulated depreciation is credited. New credit and debit accounts may also be added to track the new asset’s depreciation. However, if you needed to finance a new piece of equipment for your business, you would create a debit for your fixed asset account, and credit your liabilities to properly record the debt. As such, you would offset this debit to your cash account by crediting your inventory or asset account by $1,000. You are now without $1,000 worth of stock. However, that $1,000 hasn’t come from nowhere. If you sell $1,000 worth of t-shirts, you’ve gained $1,000 in your cash account. Whenever a debit is created by your business, a credit must be created elsewhere.įor instance, let’s say you run a store that sells t-shirts. When the sum total of all debits and credits matches, the company’s accounts are balanced.

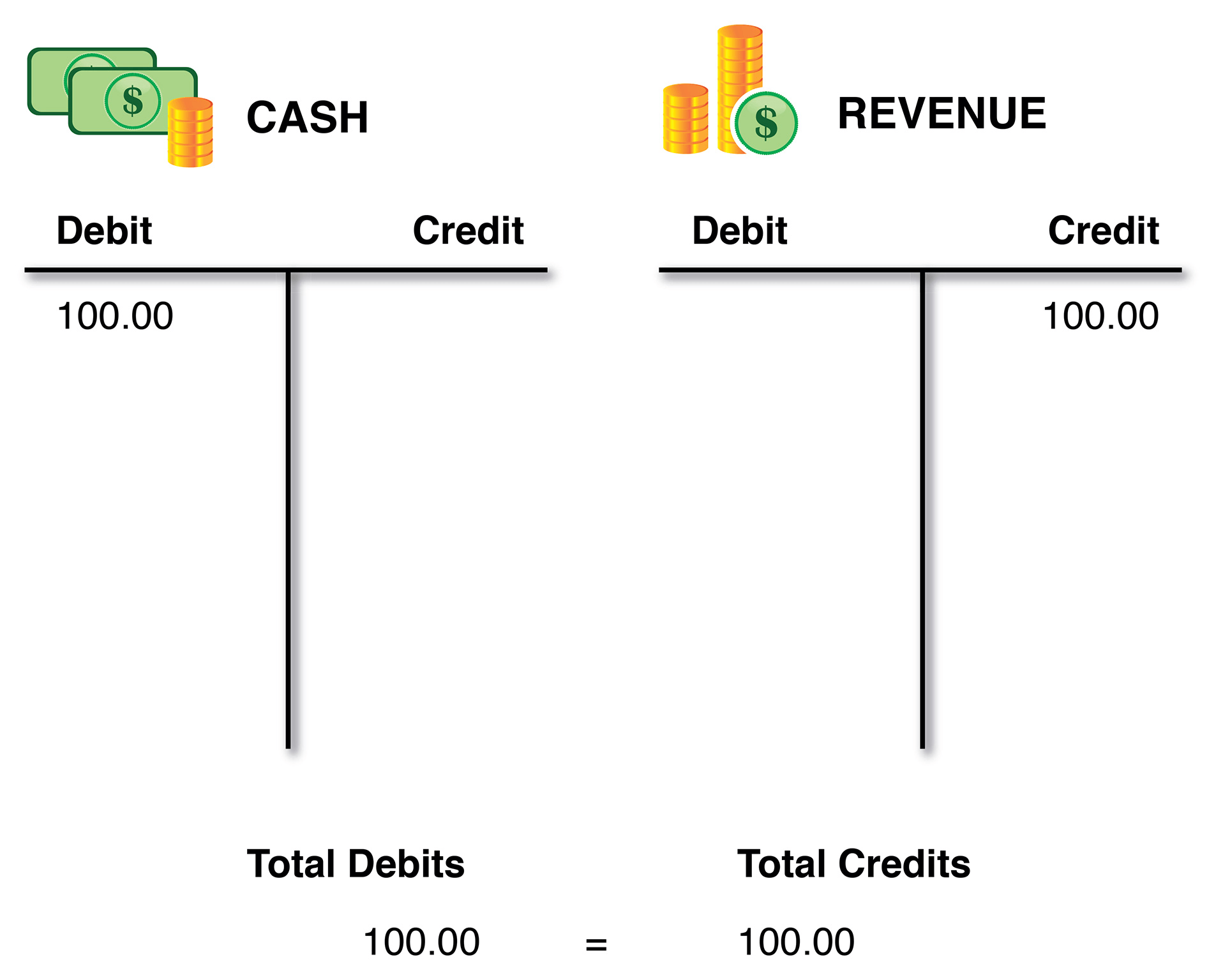

Credits, on the other hand, work in the opposite way. A debit is an accounting entry that is created to indicate either an increase in assets or a decrease in liabilities on the business’s balance sheet. But in truth, it is quite the opposite.ĭebit and credit are essential in balancing a company’s accounts. A debit may sound like something you owe. Yet its definition may not be clear to all SME owners. The word debit is as old as the discipline of accounting itself. Accounting teams need to keep a close eye on a company’s acquisitions, debts, expense accounts, capital expenditures and other transactions by recording them as credits and debits. The more of the former and the less of the latter appear on your balance sheet, the healthier your company’s finances are perceived to be. Your business finances are made up of two components: assets and liabilities. For specific advice applicable to your business, please contact a professional.

This article is for educational purposes and does not constitute financial, legal or tax advice.

0 kommentar(er)

0 kommentar(er)